Every year, local government waits patiently for the annual finance settlement to discover its fate for the coming year, but this year it waited longer than most. It was 19 December before communities secretary Sajid Javid made his statement to Parliament.

In the third year of a four-year deal, few were expecting significant change in the provisional settlement – but with increased pressures on adults and children's services and massive cuts to local authority budget, finances are stretched to breaking point. After the fall of the local government finance bill, there seems to be no solutions in sight.

In short, most councils will meet their budgets, but services are starting to crack and there is no long-term plan to balance the books beyond 2020. The finance settlement announcement did little to ease the burden.

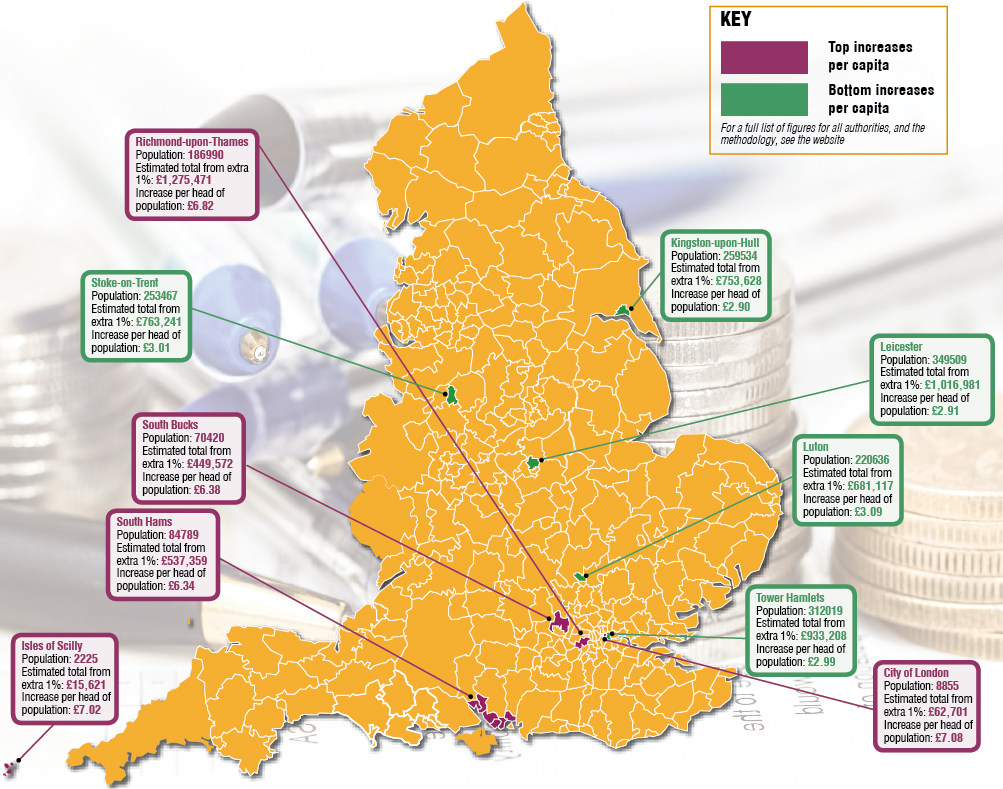

The highlight of the secretary of state's speech was his plan to allow a further 1% on council tax without the need for a referendum. While loosening the fiscal reins is good news, the local government finance system is now so woefully outdated and underfunded, the cash raised is unlikely to make a dent in the deficit.

According to Local Government Association calculations, the sector is facing a cash shortfall of £5.8bn by 2020. With a 1% council tax increase predicted to raise approximately £227m a year, it does not go far enough to plug the gap.

Local Government Association chairman Lord Porter says of the option to raise more taxes that ‘the principle is right'. Councils should have control of their own fiscal affairs. But he says: ‘Large scale national problems [like adult social care funding] can't be fixed by raising random amounts of money across the country. That should come out of national funds, not local taxes.'

The issue is that places with historically low council tax can raise less from the 1% increase – and equally councils in poorer areas with low cost property will lose out. Overall, he points out that council tax increase taxes no account of wealth or ability to pay.

While Lord Porter agrees local services should be funded by council tax, he claims adult social care should come from a national funding source such as national insurance.

Chief executive of the Chartered Institute of Public Finance and Accountancy, Rob Whiteman, told The MJ: ‘It is very difficult for local government, because in a system that needs massive reform, very little changes.'

He points out the changes to council tax will vary from one authority to the next. In London alone, he suggests the 1% rise ‘is worth three times as much in Barnet as it is in Barking and Dagenham' – two London boroughs just 12 miles apart. The same is true for Essex CC, which gets three times as much as Cumbria.

‘If this were one of several measures to help local authorities deal with pressures, it may not matter so much, but because the Government is doing so little, it really is the only show in town.'

He claims the finance system is ‘broken beyond the next few years', with very little likely to come out of the fair funding review, the green paper on social care pushed back, and a limit to the number of councils that can be business rate pilots.

‘The sector needs to speak on a cross party combined basis that it is heading for very significant problems. My worry is we will be divided and ruled. Everyone will try to be a business rate pilot, Mr Whiteman says. ‘If the Government gets us to try to turn on each other and get a bigger share of the pie, local government will be the loser.'

Nearly nine years – and a 40% cut in funding – after former Audit Commission chief executive Steve Bundred warned local government was facing a funding ‘Armageddon' councils are still carrying on.

Mr Whiteman says: ‘What is the definition of councils falling over? Councils will set a legal budget, but if we are now living in a country with hardly any food inspection and provision of social care are on the margins of legality.'

While they are not facing fiscal collapse, he suggests council services are cracking, and the finance settlement has done nothing to resolve the future of funding.

‘I'd like to see the Government put more in to reverse some of the cuts in revenue support grant – and to win a battle with treasury to say the cuts have gone too far,' Mr Whiteman says.

‘There is no excuse for the Government not bringing a fair funding review forward. It is the job of government is to make sure there is a proper basis on which to provide services. Local government funding is not sustainable by the end of this parliament and social care is not sustainable.

‘Tinkering at the edges with council tax precepts and reversing negative RSG – it is teetering at the edges of what is wrong without putting it right.'